Ever had a client fall in love with your proposal only to later push back on every key term in your contract? It’s an all-too-familiar situation in the agency world: a client green-lights your project at $100,000, but then negotiations chip away at the clauses that protect your agency’s interests. Suddenly, they’re requesting net 60 payment terms, rejecting your portfolio rights, and insisting on a high-risk indemnity clause. Now, that $100,000 quote doesn’t quite seem worth it.

We often hear from agencies facing this dilemma. You want to be fair and transparent, but once you’re in contract negotiations, the scope of work isn’t what’s changed — the legal risks and operational burdens have. This is where a Pricing Matrix can help you recenter the conversation and keep your project profitable. Here’s how to use a Pricing Matrix to put a price on contract markups, reduce surprises, and avoid scope creep.

What Is a Pricing Matrix?

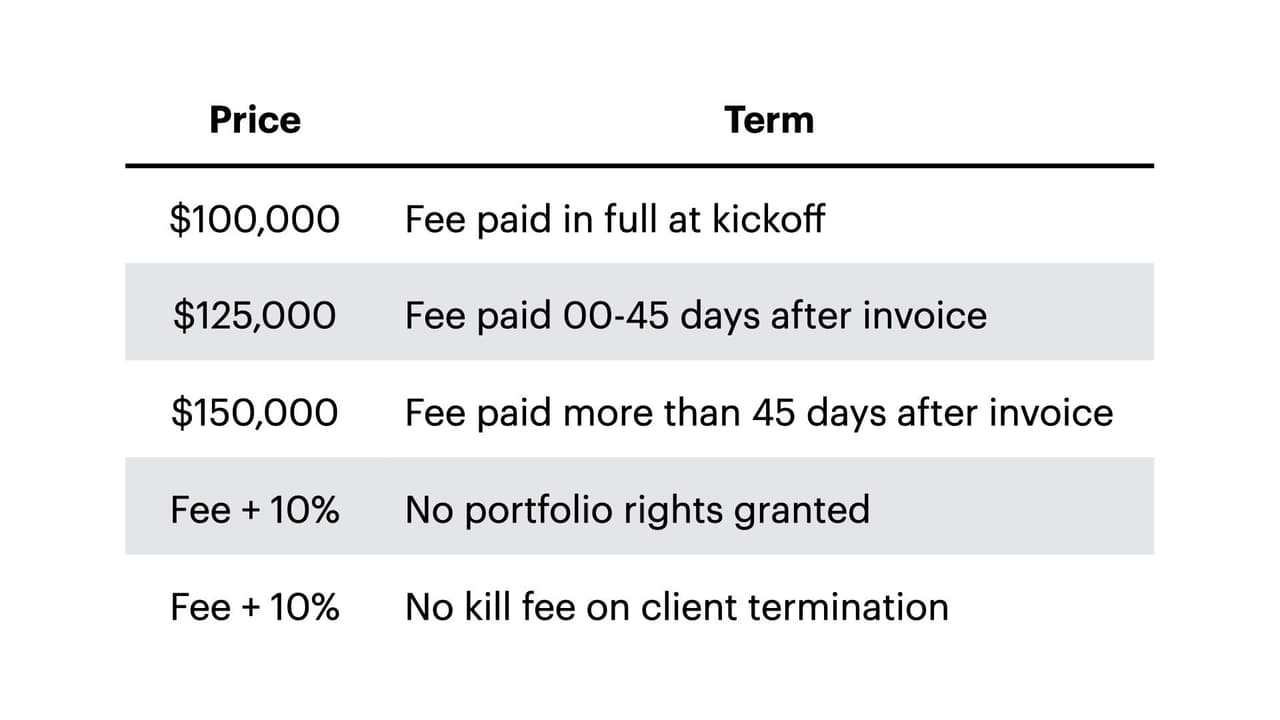

Think of a Pricing Matrix as a proactive tool that clarifies how changes to your standard contract terms affect the cost of a project. Most agencies are familiar with tiered service pricing (good-better-best models). A Pricing Matrix applies a similar approach, but for key business and legal terms. For example, you might create a matrix that outlines added costs if a client requests longer payment terms or rejects your portfolio rights.

This tool empowers you to let clients know upfront that certain contract adjustments will alter the final price, just as if they had asked for additional deliverables.

Why Use a Pricing Matrix?

1. Aligns Client Choices with Costs

The Pricing Matrix serves as a reality check for clients who might be quick to request legal changes without considering the impact on your bottom line. By associating a price change with each amendment, you make it clear that every deviation from standard terms has real financial implications. This discourages excessive markups by ensuring the client’s legal team is accountable to their business team for increasing project costs.

2. Eliminates Bait-and-Switch Concerns

Adding a Pricing Matrix to your proposal or estimate avoids the dreaded bait-and-switch feeling. The client knows from the start that certain terms come with specific fees, and you can remain transparent about price changes due to contractual modifications. While they may not be thrilled with extra charges, they won’t feel blindsided, which builds trust.

3. Reduces Emotional Stress in Pricing Conversations

Discussing pricing can be uncomfortable, especially if you’re put on the spot during a contract review. A Pricing Matrix gives you a set script and guidelines, making it less of a personal negotiation and more of a practical review. It’s easier to point to a pre-established table of adjustments than to renegotiate each item individually, reducing the emotional strain.

4. Protects Your Margins and Project Profitability

Contractual terms directly impact your project’s profitability. If a client denies portfolio rights, you lose a marketing opportunity; if they insist on net 60 payment terms, your cash flow takes a hit. A Pricing Matrix accounts for these intangibles. You shouldn’t have to accept unfavorable terms without compensation, and a well-crafted matrix helps ensure you’re paid fairly for the added risks or limitations.

Key Terms to Include in Your Pricing Matrix

The terms you include in your matrix will vary based on your agency’s priorities, but here are a few high-impact clauses worth considering:

- Payment Terms: This is a major factor in cash flow. Consider options like net 15, net 30, and net 60, and adjust prices accordingly. For example, you might charge 5% less for net 15 payments or 10% more for net 60 to reflect the added risk and working capital needed. Your normal pricing should be for payment in advance either as a lump sum or in installments during the project. Increase from there.

- Portfolio Rights: Portfolio rights allow you to showcase completed work, which is essential for marketing and attracting future clients. If a client rejects this, you could apply a 10 – 15% surcharge to compensate for the lost opportunity.

- Kill Fees: If a client wants the flexibility to cancel a project without a standard kill fee, adjust your pricing to reflect this lack of security. Without a kill fee, you carry more risk, which should be reflected in the project’s cost. Again, your normal pricing assumes that a kill fee will be in the contract. A higher price is quoted for clients that won’t agree to a kill fee.

- Indemnity and Liability Clauses: Broader indemnity clauses or higher liability caps expose your agency to increased legal risk. You might apply a pricing adjustment based on the extent of the client’s requested coverage.

How to Introduce the Pricing Matrix to Clients

When presenting a Pricing Matrix, keep the language straightforward and focused on how their choices affect pricing. Here’s an example of how to frame the conversation:

“Our $100,000 fee assumes our standard terms. If the client requests adjustments, like extending payment terms or removing portfolio rights, it may impact the project cost. We’ve outlined those possible adjustments below for transparency. Please feel free to reach out with any questions about these terms or potential cost changes.”

Including this with your initial estimate or statement of work establishes the matrix as part of your proposal’s framework, setting client expectations early.

Example of a Simple Pricing Matrix

Making It Work for Your Agency

Adjust your Pricing Matrix based on the client and the project’s specifics. For a longstanding client, you may want to be more flexible, while a new client might merit a stricter approach. Additionally, complex projects like video production might involve different terms than simpler, shorter engagements.

The Pricing Matrix isn’t just a tool for fairness; it’s a way to take control of the negotiation process and preserve profitability. By clearly associating legal and business terms with their impact on pricing, you position yourself as a confident partner who values transparency, clarity, and a fair exchange of value.

So next time a client wants net 60 terms or restricts your portfolio rights, you’ll be prepared with a tailored, consistent response that’s built to protect your agency’s interests.