You have probably heard about the new Corporate Transparency Act that went into effect on January 1, 2024. It may sound like a big confusing federal law, but what does your agency need to do to comply?

Short Update: You don’t need to do this :)

Longer Update: On March 1, 2025, FinCEN announced that it will not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines. No fines or penalties will be issued, and no enforcement actions will be taken, until a forthcoming interim final rule becomes effective and the new relevant due dates in the interim final rule have passed.

What does the new law do?

The Act requires most companies to report personal information about their owners to the Financial Crimes Enforcement Network (FinCEN). The purpose of the Act is to crack down on the abuse of shell companies and to combat money laundering, financing of terrorism, and other illicit activities. While this is a laudable goal, it also creates an invasive new reporting requirement for most companies — likely including your agency.

How does this impact my agency?

First, be aware that there are already scams and fraudulent mailings associated with the FinCEN filing. FinCEN will not send out unsolicited requests. Don’t click on any links or QR codes you see in correspondence allegedly from FinCEN.

Second, many agencies will need to file a report with FinCIN, even very small ones. While there are some exceptions (things like publicly traded companies, nonprofits, public utilities, etc), only one of them is relevant to agencies: the large operating company exemption. To qualify for that exemption, your agency must:

- have 20 or more US full-time employees (contractors and foreign workers don’t count);

- have a physical presence in the US (remote work from employee residences can qualify, a primary office outside the US does not); and

- more than $5,000,000 in gross sales from US based customers in the prior taxable year.

The exemption is self-executing. This means that there is no need to apply for the exemption or report that your agency is exempt. Rules for this exemption are expected to continue to develop. So be sure to consult with your lawyer for specifics about these requirements and updates.

For those agencies that are not exempt, these are the important requirements:

If your agency existed before January 1, 2024, your deadline to file is January 1, 2025. For existing agencies, you can do it now if you want to get it out of the way.

If you start a new agency or other new company after January 1, 2024, you need to file the report within 90 days of formation.

After you file an initial report, you will need to file an update within 30 days of any changes to the information included in your initial filing (or within 30 days of losing an exemption, if you are originally exempt).

Whether an existing business or a new business, don’t let that deadline slip past! There are penalties of up to $500 per day for failure to file. That can add up!

What do I need to do?

One piece of good news: there is no filing fee for the report and it is a one-time thing (not an annual reporting requirement). After the initial filing, you only need to file again if there are updates or corrections. Also, the information you file is not publicly viewable. The government says it will keep it secure and confidential.

To complete the filing, you’ll need to gather the following information:

Company Applicants. If your agency was formed on or after January 1, 2024, you’ll need the name of the one or more people who directly filed the document with the secretary of state and also the person who was responsible for directing or controlling the filing of that document. If you filed on your own, then you would be the Company Applicant. If you used a service like LegalZoom or a law firm to file, then the Company Applicants would be you plus the service or law firm.

Beneficial Owners. For this filing, you’ll be reporting about beneficial owners of the business.

A person can be a beneficial owner if they satisfy either of the following two tests :

- A person is a beneficial owner if they own or control at least 25% of the ownership interest of the company. If your agency owns or controls another company, then the beneficial owners of parent company must be reported.

- A person is also a beneficial owner if they exercise substantial control over the business. This includes people like senior officers (President, COO, CEO, CFO). It can also include a person that has substantial control by contract, even if they aren’t involved in the day-to-day operations of your agency. An example might be someone that has the right to approve big decisions like mergers or amendments to the company’s governing documents, or someone that can name a majority of the board of directors.

Some people will qualify as beneficial owners under both of these tests. If someone owns less than 25% or if they own something like phantom stock, they are not considered “beneficial owners”. Similarly, a person that is only on the board of directors (without 25% ownership or substantial control), likely is not a beneficial owner.

Once you’ve identified everyone that constitutes a beneficial owner, you’ll need to gather the following information :

- full legal name,

- date of birth,

- street address, and

- a unique identifying number from acceptable identification documents (e.g., passports, driver’s license, etc.).

File the Report. Once you’ve gathered all this information, you need to file through FinCEN’s portal. There are third-party services emerging that purport to help with the filing (for a fee). And don’t skip it! Potential penalties for failure to file are steep: $500 per day up to $10,000. Remember to update the filing within 30 days if there is a change to any of the beneficial owners or the information reported about them.

Having all this personal information together is a security issue, so be sure to keep it secure.

For more information, you can refer to these resources published by FinCIN

- Video Overview of Beneficial Ownership Information Reporting with Under Secretary Brian Nelson

- Beneficial Ownership Information Reporting Frequently Asked Questions

- FinCEN’s Beneficial Ownership Information page

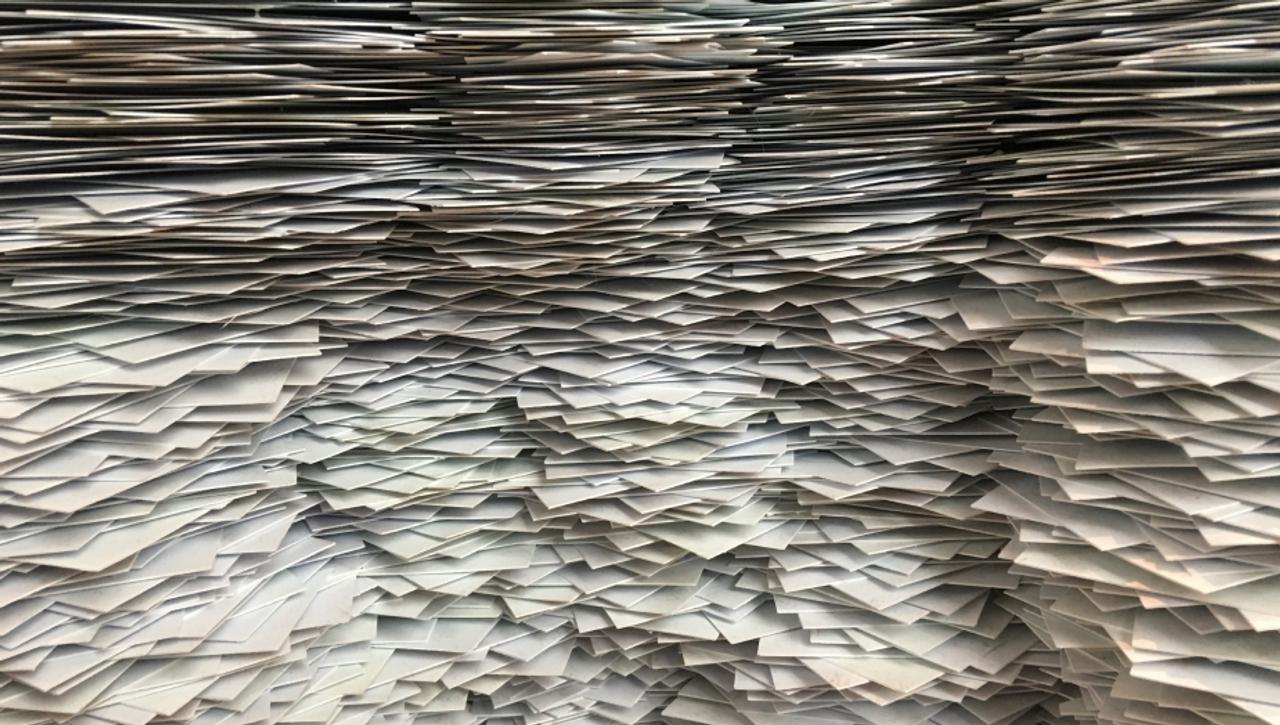

More (Electronic) Paperwork

The CTA adds another item to the stack of compliance that every agency must take care of. For your existing agency, be sure to complete your filing before January 1, 2025. And if you start something new, be sure to get that done within 90 days of formation. At this time, Matchstick is not completing these filings for its clients, but we can advise you about the requirements of the act and how to file.